The reality check

for your crypto portfolio

The reality check

for your crypto portfolio

The reality check for your crypto portfolio

Build & Manage your digital wealth -

without spending hours on research

Build & Manage your digital wealth -

without spending hours on research

1.

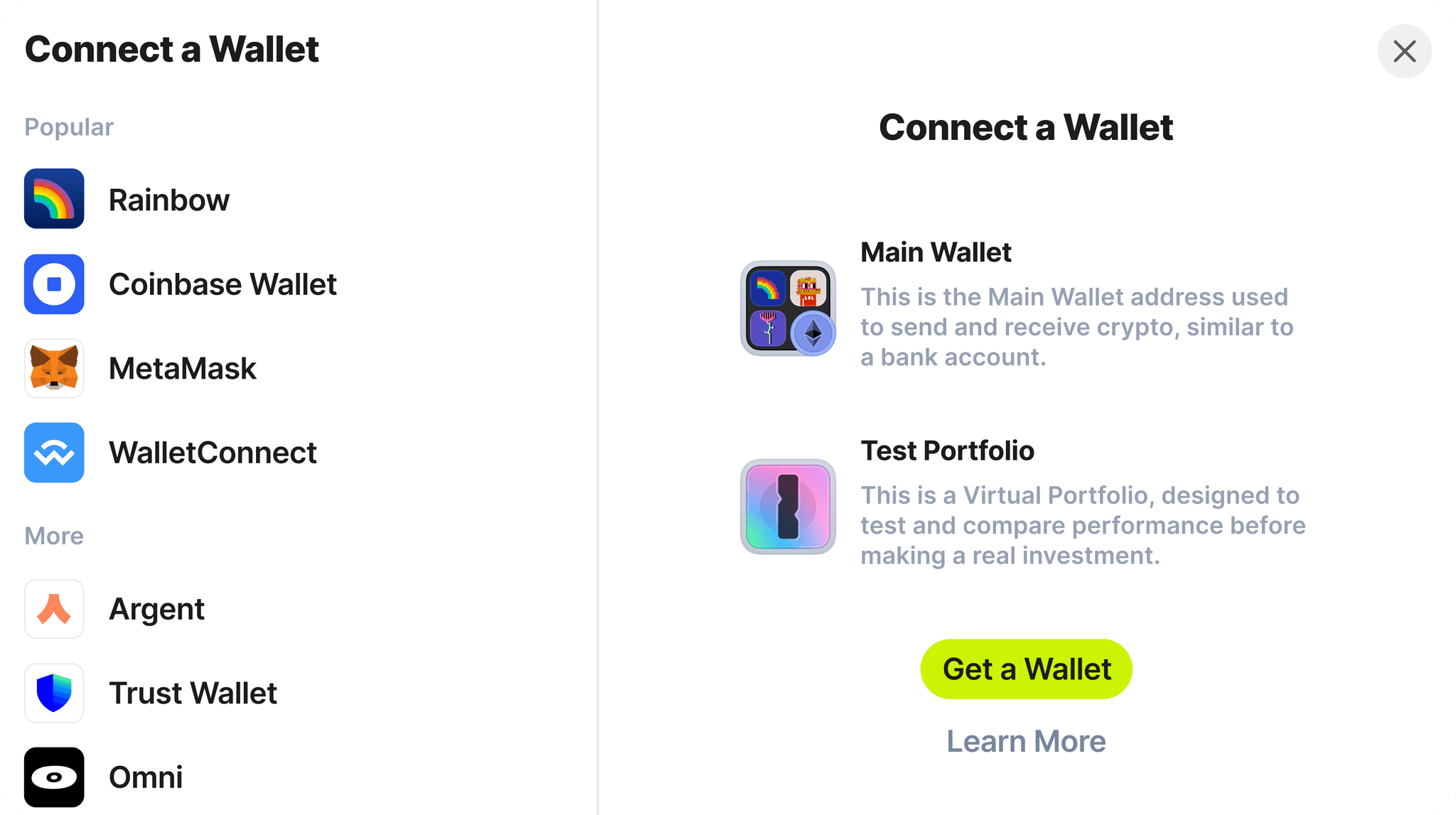

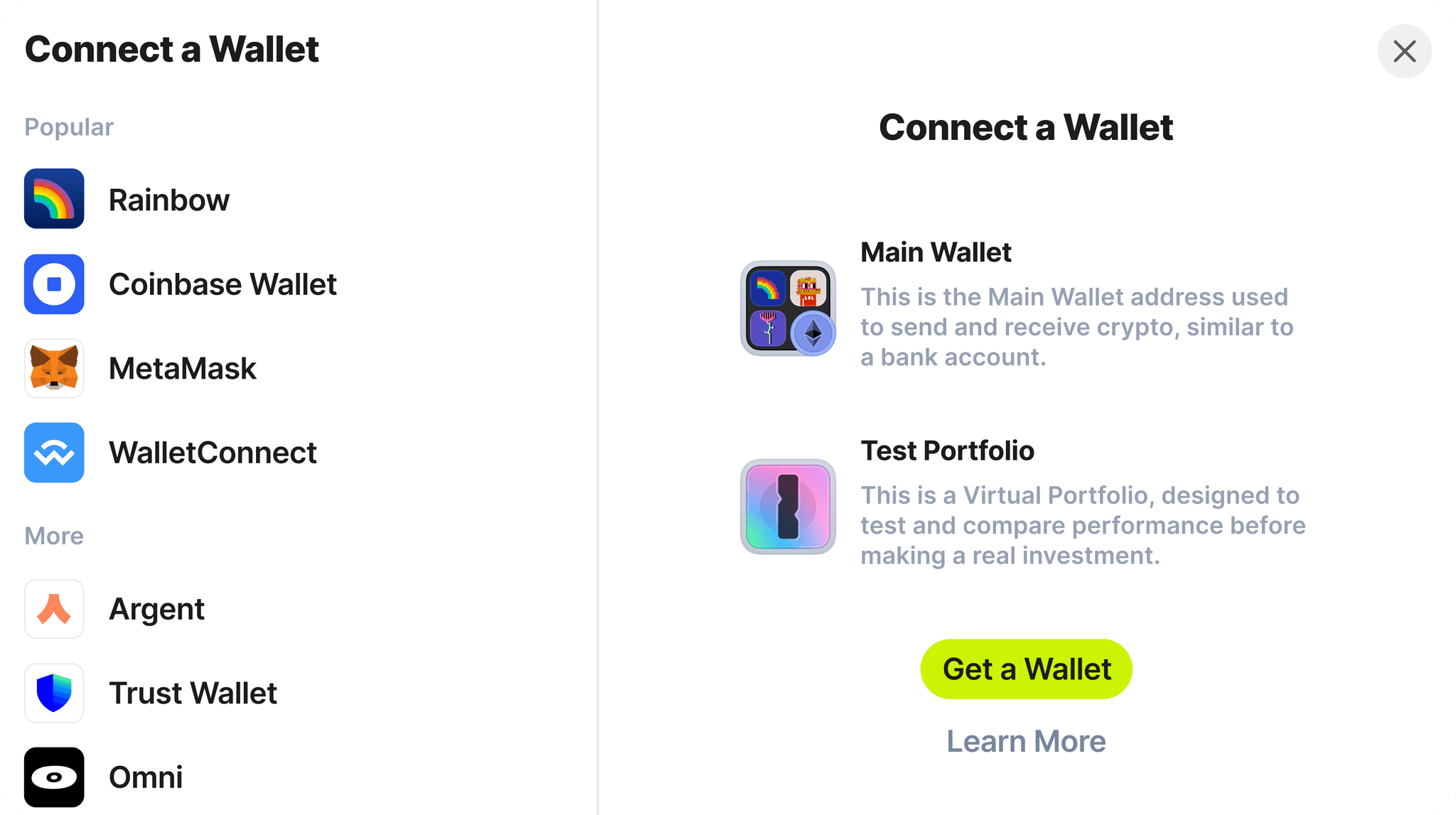

Connect your wallet with our web app

2.

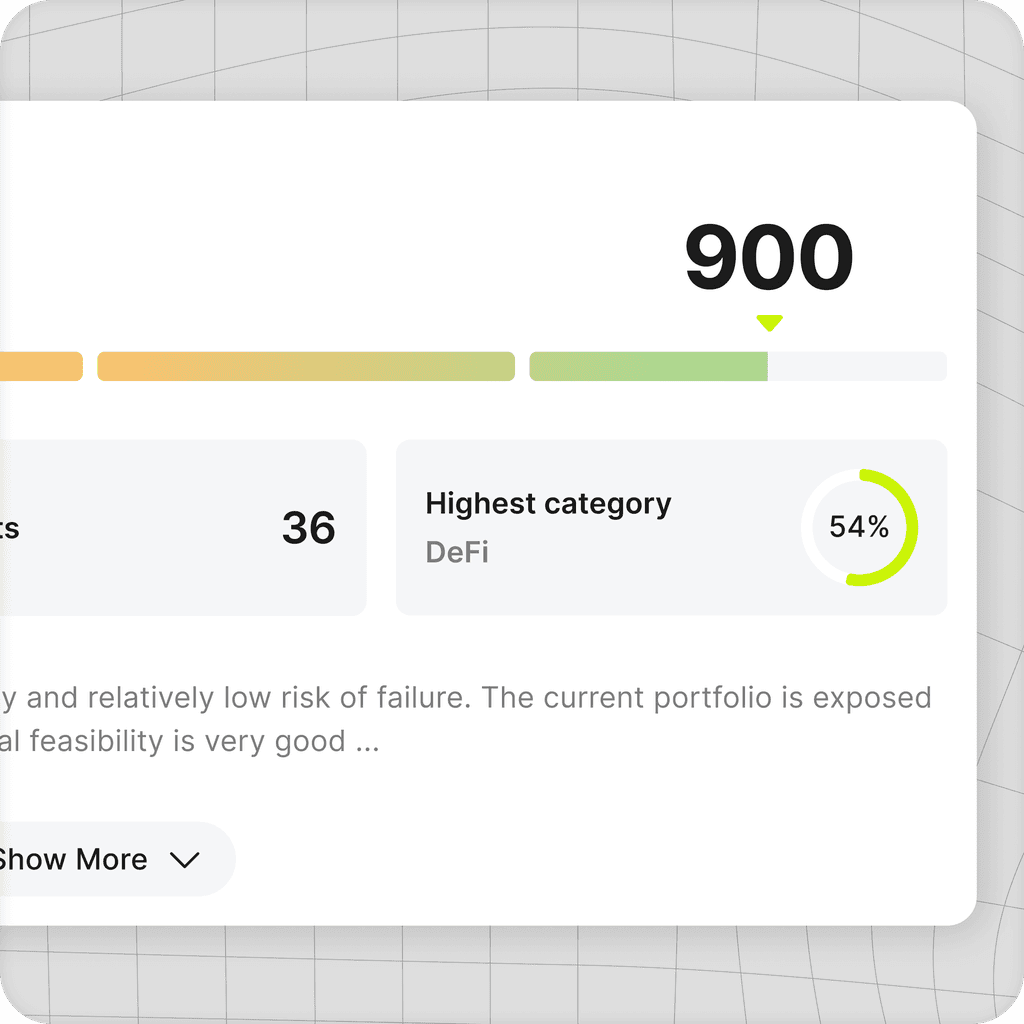

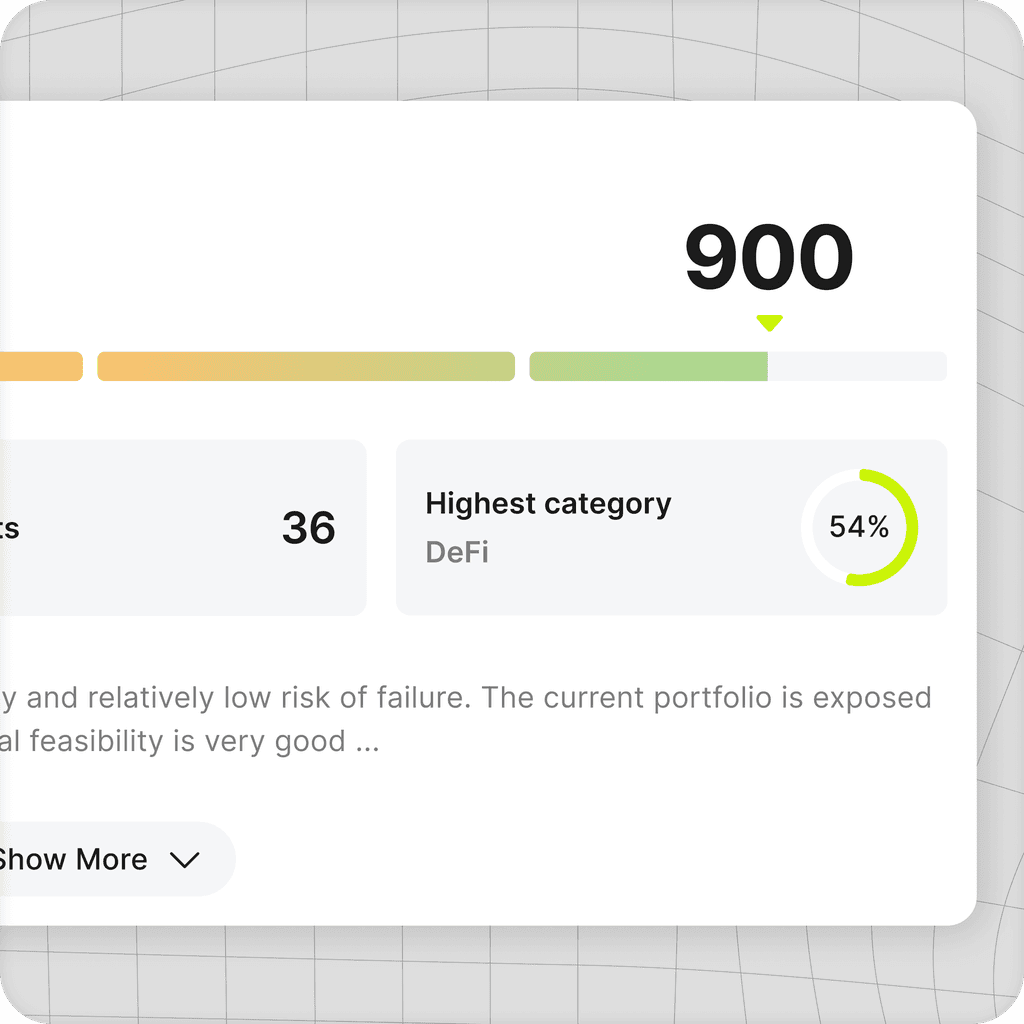

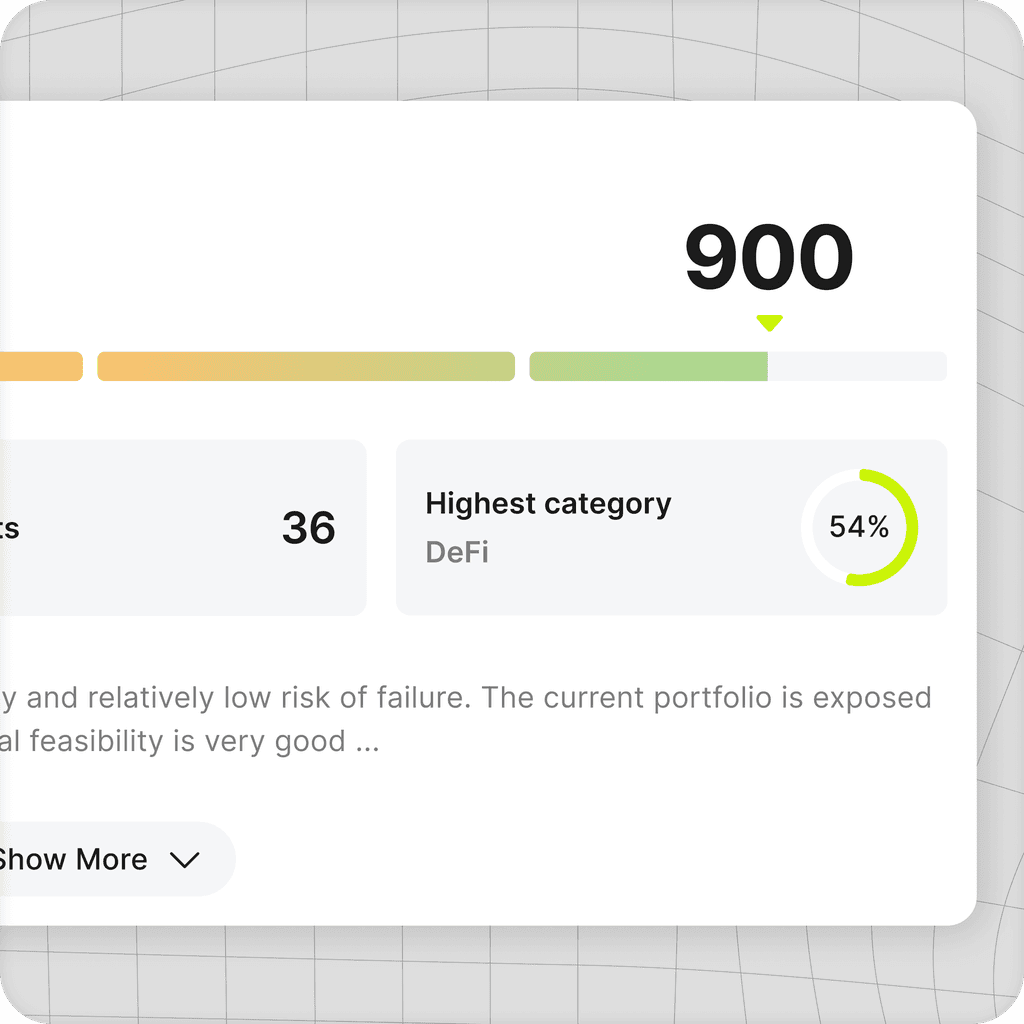

Scan you crypto portfolio and get actionable insights

3.

Grow your wealth by investing in trusted projects

1.

Connect your wallet with our web app

2.

Scan you crypto portfolio and get actionable insights

3.

Grow your wealth by investing in trusted projects

Connect your wallet with our web app

Scan you crypto portfolio and get actionable insights

Grow your wealth by investing in trusted projects

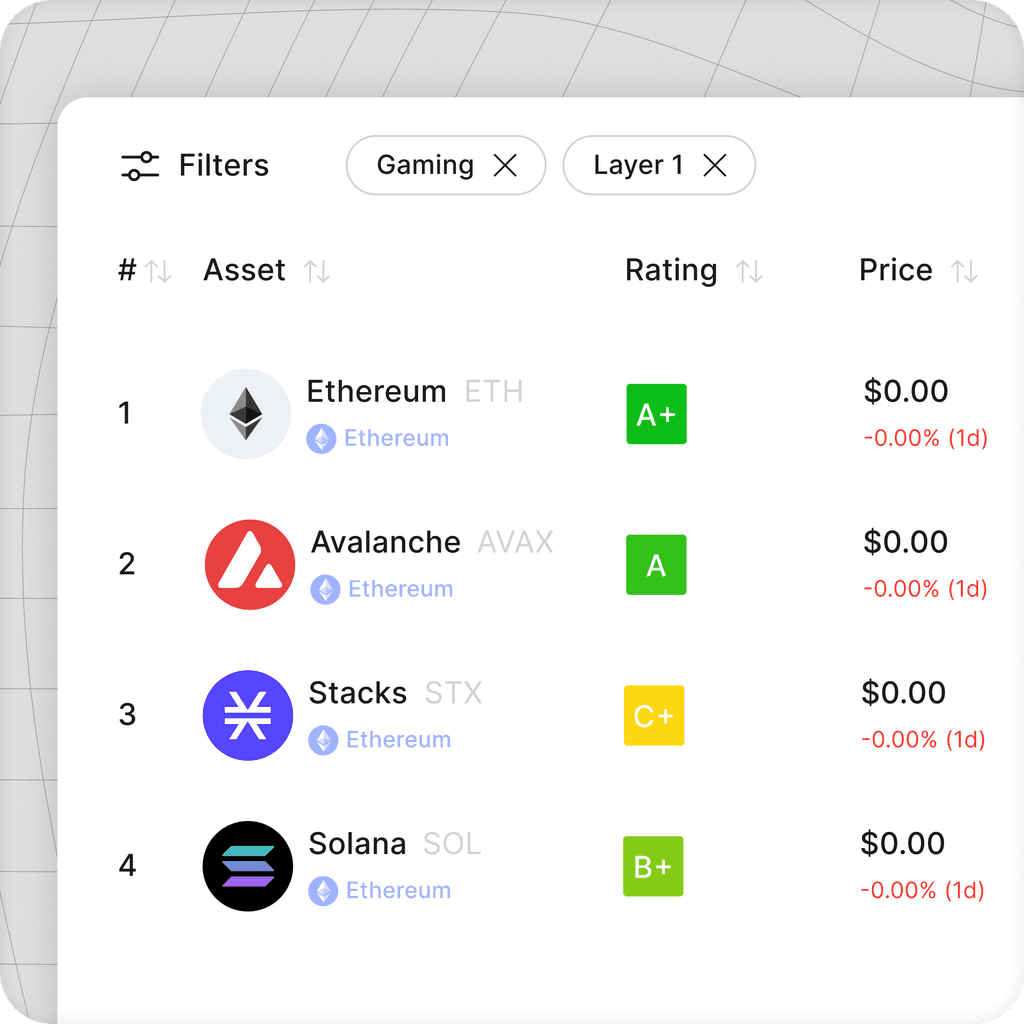

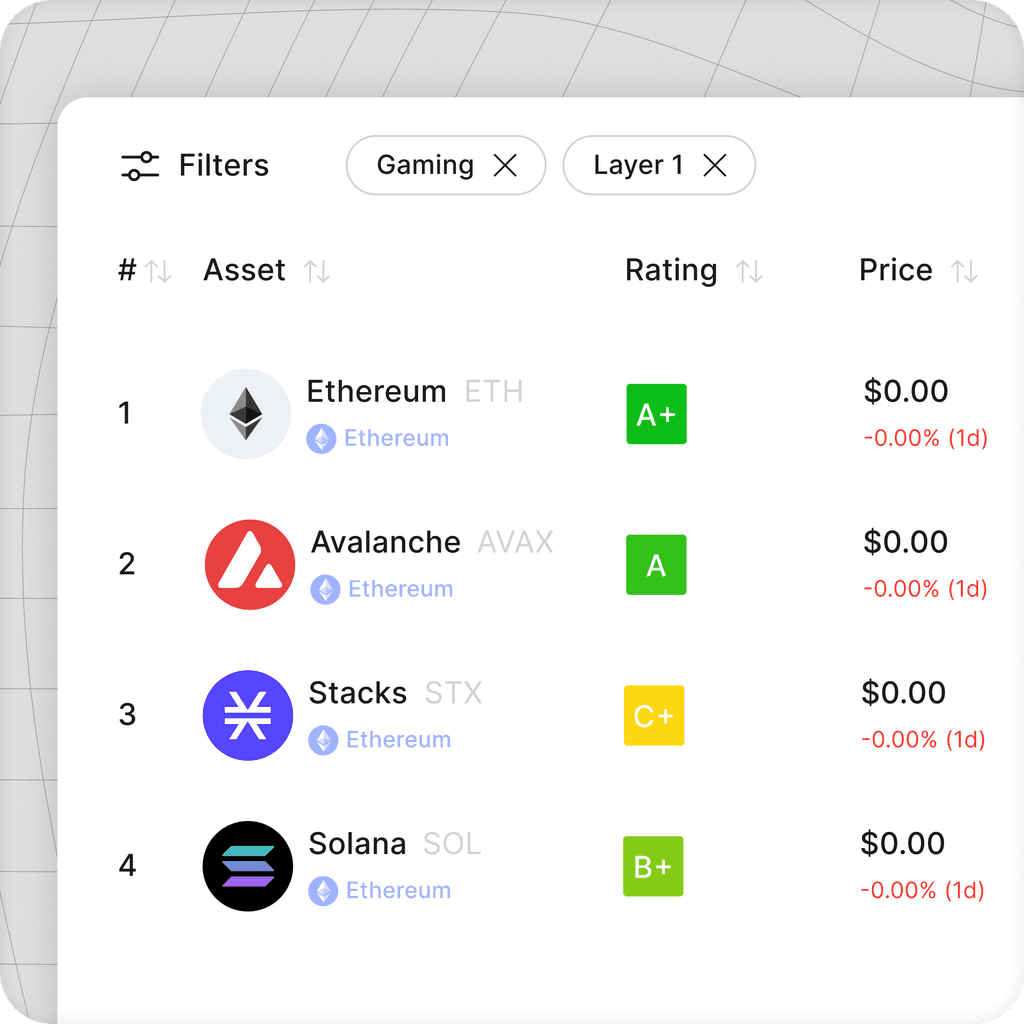

Web3 research made simple

Web3 research made simple

Web3 research made simple

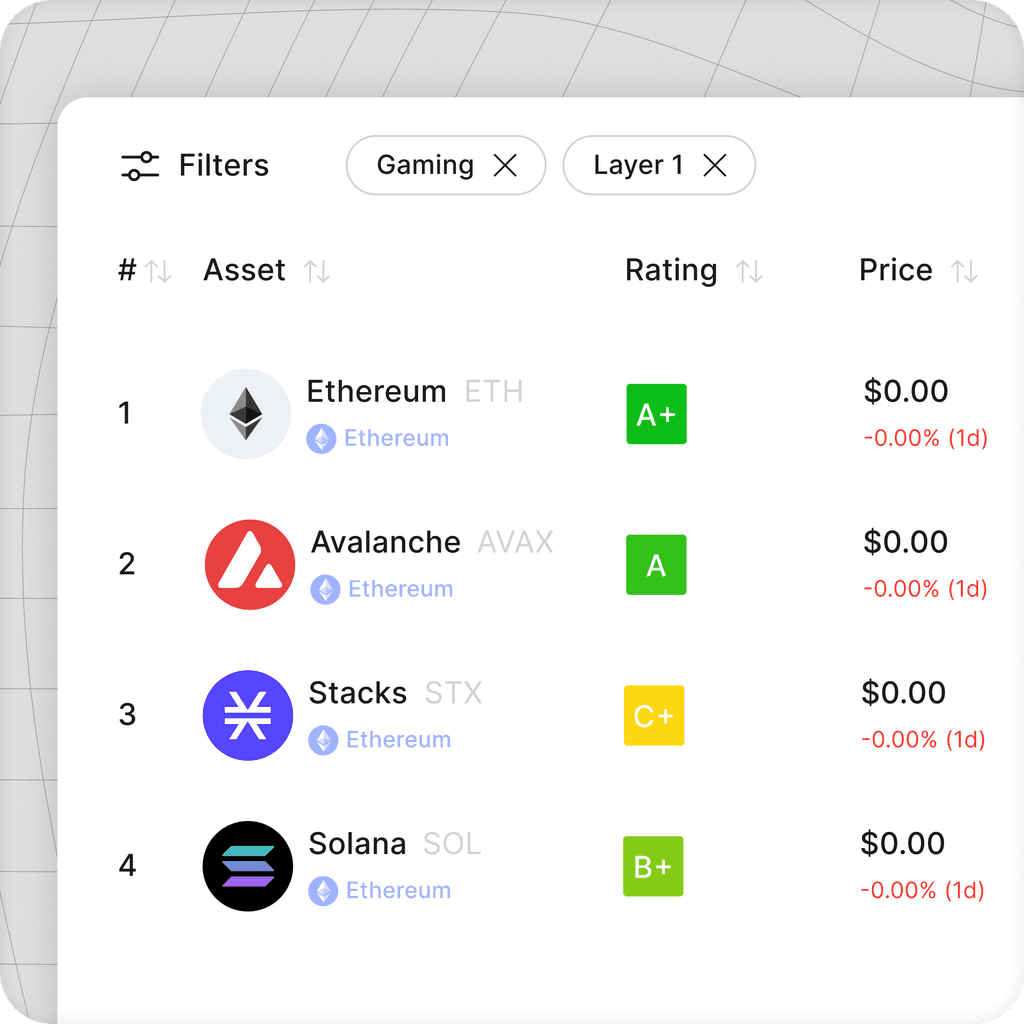

Clustr grades thousands of web3 tokens using 90+ onchain metrics and helps you build a healthy portfolio in a few clicks

Clustr grades thousands of web3 tokens using 90+ onchain metrics and helps you build a healthy portfolio in a few clicks

Explore all DeFi projects in one place

Explore all DeFi projects in one place

Explore all DeFi projects in one place

Discover thousands of DeFi projects based on your interests and get in early on the next hidden gem

Discover thousands of DeFi projects based on your interests and get in early on the next hidden gem

Turn insights into actions

Turn insights into actions

Turn insights into actions

Apply industry best practices with custom alerts and optimize your investments for longterm growth

Apply industry best practices with custom alerts and optimize your investments for longterm growth

Seamlessly integrate Clustr

with your favorite wallet

Seamlessly integrate Clustr with your favorite wallet

100% Self Custodial

100% Self Custodial

Nobody can access your wallet. You own your keys and assets

Many-To-Many

Many-To-Many

Buy, swap & sell multiple coins in one transaction

Real-time Alerts

Real-time Alerts

Get notifications on your tokens based on market news

Want Zero-Fee Trading?

Sign up for Future Releases!

Want Zero-Fee Trading?

Sign up for Future Releases!

Want Zero-Fee Trading?

Sign up for Future Releases!

Clustr NFTs aren’t just pretty pictures. Owning one will grant the wallet owner perks, such as being exempt from Clustr's swap fees.

Clustr NFTs aren’t just pretty pictures. Owning one will grant the wallet owner perks, such as being exempt from Clustr's swap fees.

Clustr NFTs aren’t just pretty pictures. Owning one will grant the wallet owner perks, such as being exempt from Clustr's swap fees.

Join the Clustr community

Join the Clustr community

Join the Clustr community

FAQ

Can I buy crypto through your website?

What is Clustr?

How can I use Clustr?

What type of data do you use?

How do you analyse projects?

How do you grade my portfolio?

Do you show risk based on performance?

Is this financial advice?

Can I buy crypto through your website?

What is Clustr?

How can I use Clustr?

What type of data do you use?

How do you analyse projects?

How do you grade my portfolio?

Do you show risk based on performance?

Is this financial advice?

Stay tuned for our upcoming launch

Stay tuned for our upcoming launch

Subscribe so you don’t miss it

Copyright © 2024 - Made in London with ❤

Clustr is a trading name of Clustr Tech Ltd. Company number: 13746499.

Copyright © 2024

Made in London with ❤

Clustr is a trading name of Clustr Tech Ltd. Company number: 13746499.

Want Zero-Fee Trading?

Want Zero-Fee Trading?

Want Zero-Fee Trading?